What the Fed’s Rate Cut Really Means

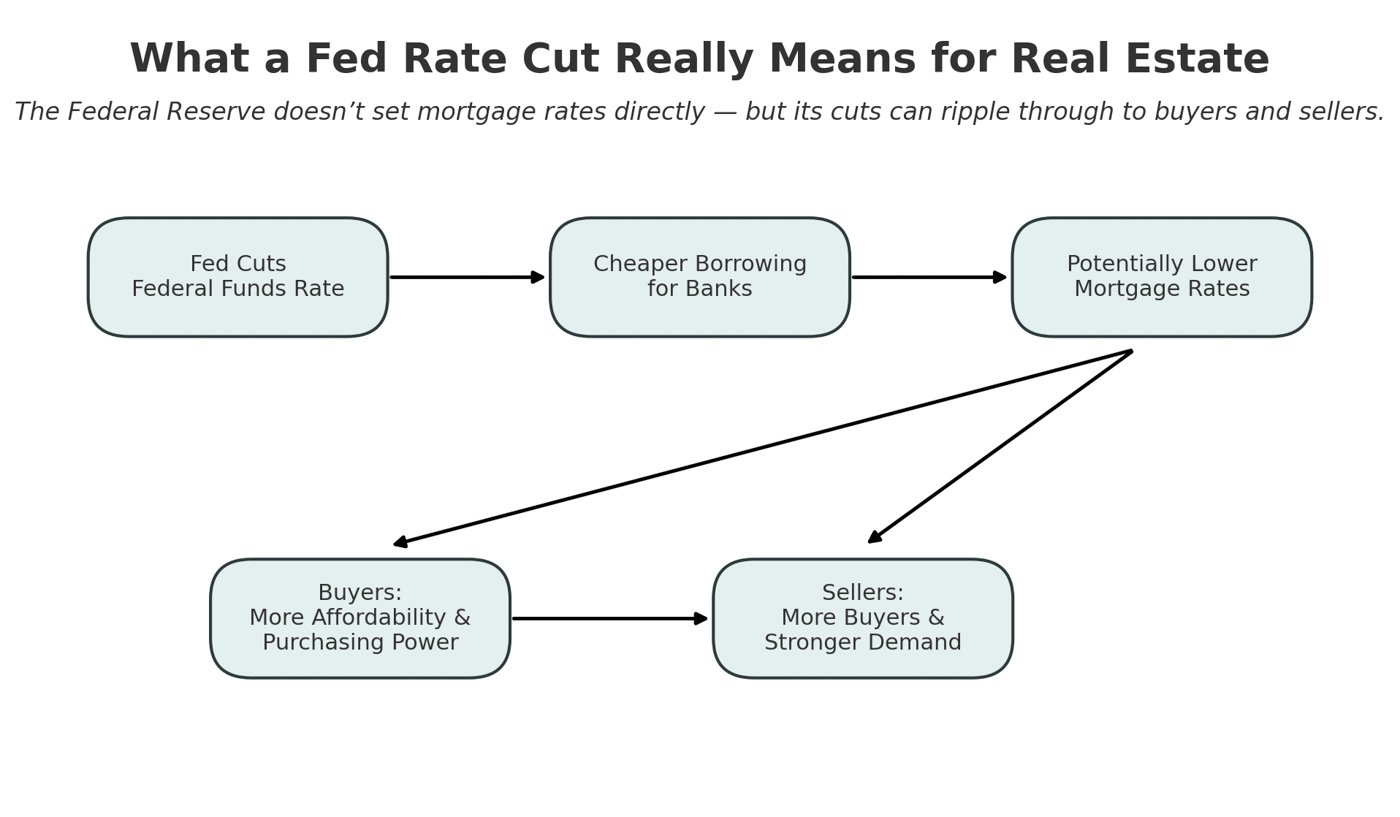

The way officials talk about the Fed's rate cuts can sound complicated and full of technical language to the average person. Rather than wasting you're time trying to figure out what they're doing, this is what's really going on.

The Fed Is Making Borrowing Cheaper

Mortgage Rates Begin to Shift

Monthly Payments Start to Come Down

Sellers Have a Better Chance of Finding Buyers

It’s not just buyers who win, sellers do too, since buyers can afford more, and new customers enter the market, increasing the chances of higher profits.

So, What Exactly Is the Fed up To?

The Fed's thinking here is that by cutting the Federal Funds Rate, it will inevitably stimulate the economy, as it makes borrowing money cheaper than before. And with this comes more activity in the real estate market, as we've just laid out.

But why?

Let's look at it with a real-life example. When interest rates drop, it means that if you have bought a house, the payments you make decrease, putting more money in your back pocket.

So, imagine your monthly payments were cut by $400 a month, that would leave you with that extra amount every month, making it much easier to buy a property. And when millions of other people are in the same situation as you, buyer activity in the real estate market surges.

However, as we've mentioned, it's not just buyers who reap the rewards, sellers do too, making it a win-win for everyone. Remember, sellers are also buyers as well, so when they eventually sell their property, they're going to need to buy a new one to live in, which puts the money back into the market. If that wasn't enough, the higher demand from more people willing to buy a home also increases purchasing power, which in turn bumps up home prices.

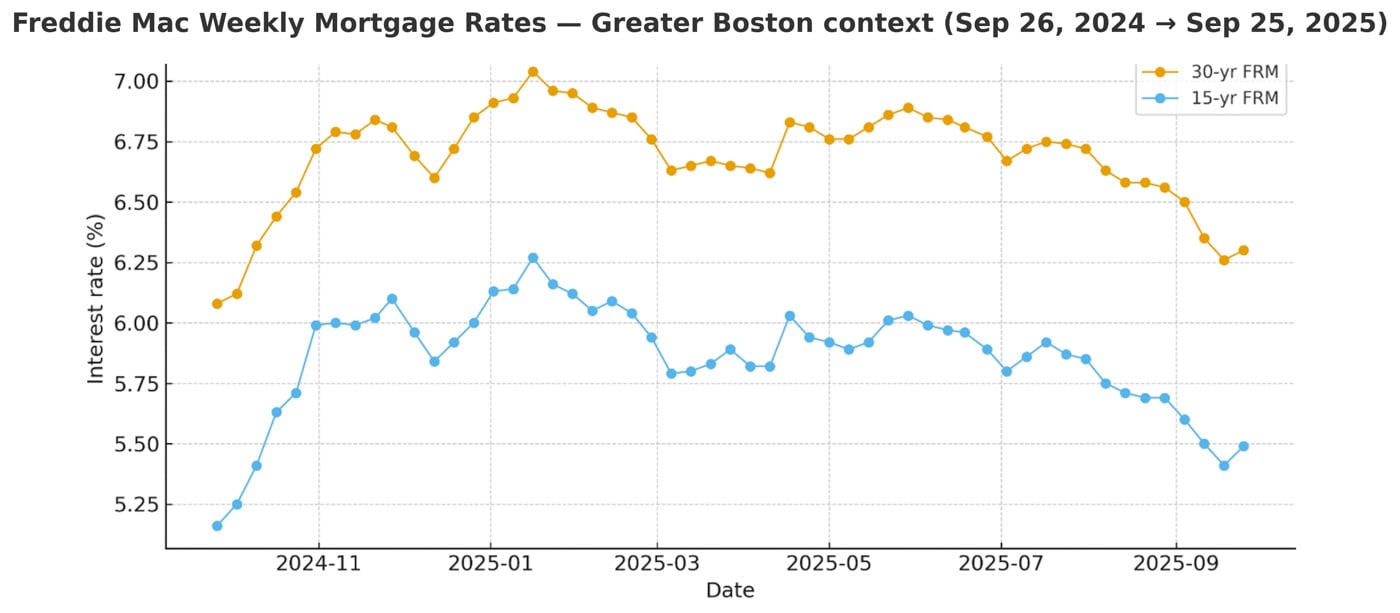

Here's some insight into just how much you could be saving.

For a 30-year fixed-rate mortgage:

* 7.00% rate → ~$4,191/month

* 6.25% rate → ~$3,879/month

* Savings → about $312/month

For a 15-year fixed-rate mortgage:

* 6.25% rate → ~$5,402/month

* 5.50% rate → ~$5,148/month

* Savings → about $254/month

Everyone in the Market Benefits, Both Buyers and Sellers!

Let’s be real, the Fed and interest rates are complicated topics, but Oak Realty is here to make them sound simple, so you know how they can benefit you.

To conclude, the Fed has just lowered its rate. This means mortgage rates will likely follow, giving buyers smaller monthly payments and more purchasing power, while sellers will enjoy stronger demand and better prices. It's bound to have a positive ripple effect for everyone involved!