Buy With Oak Realty

We're here to guide you through every twist and turn of the buying process, so that you can sleep easy at night (in a home that you love ♥).

What do you see when you visualize your dream home? We ask you this, as it’s important that we see the same dream. We realize that the very best way to assist our real estate buyers to locate precisely the right home is to put myself into our buyer clients’ shoes.

We're here to serve our buyers and create more than satisfied buyer clients. You can begin to experience my award winning service by filling in the buyer interests questionnaire on this page. We’ll jump right in with targeted searches and email alerts to put you in charge of your home buying process.

Have you ever worked with a real estate agent who showed you where to search for properties then told you to call them when you find what you want to see? That’s what we’d call Level 1 service. We have been recommended highly by our past buyer clients because we provide a much higher level of property search services!

* Yes, we provide a search page on my site, but we do more for our buyers. We provide help in knowing how to use the search for optimal results, including explaining some of the information fields and real estate jargon.

* From our search page you can request more information on any listings of interest with a quick and simple form.

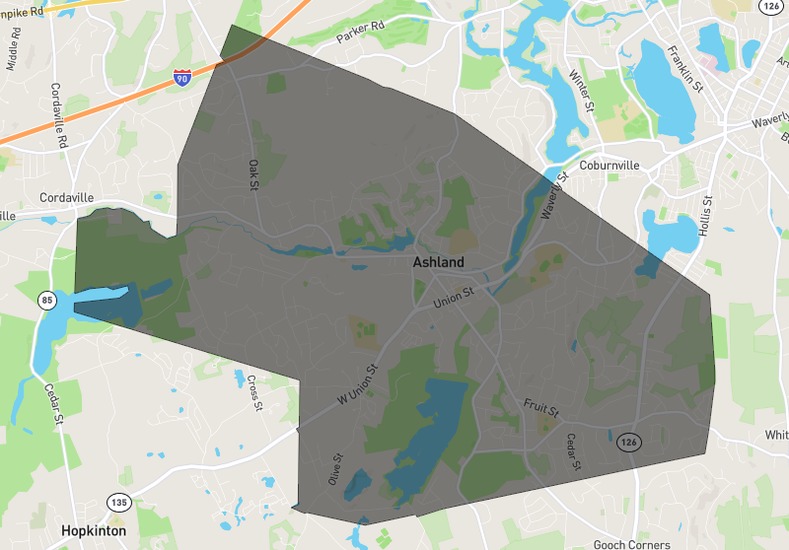

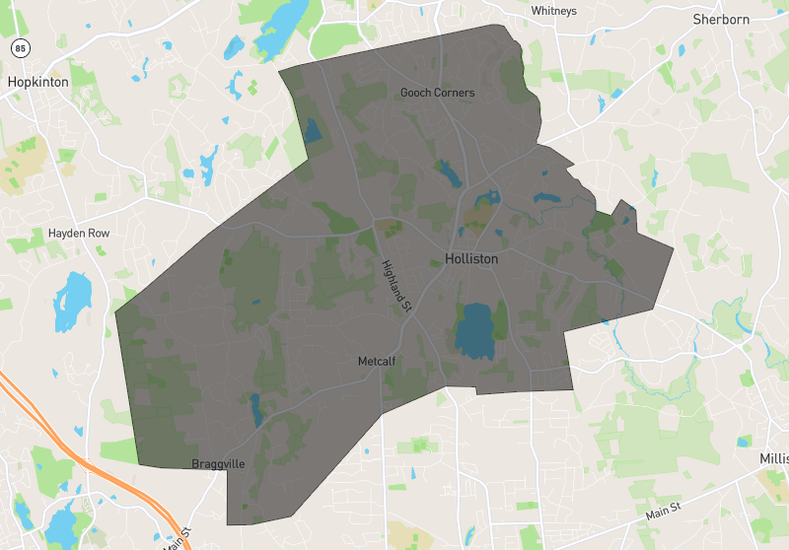

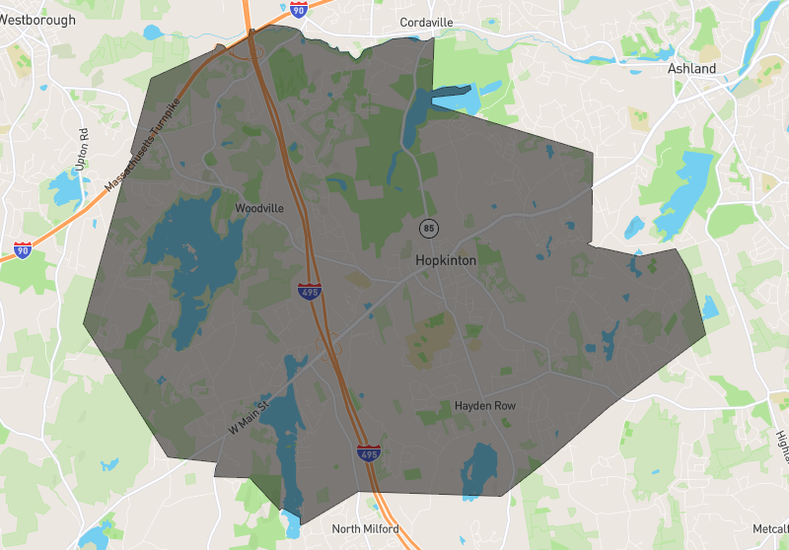

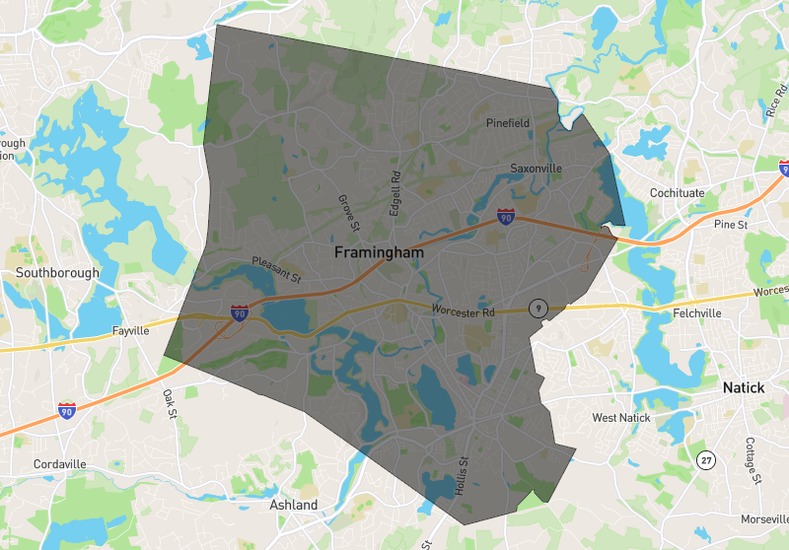

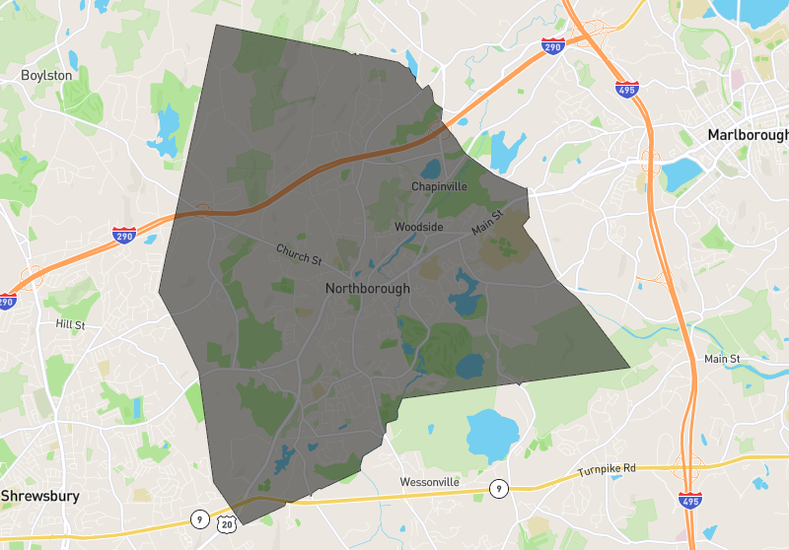

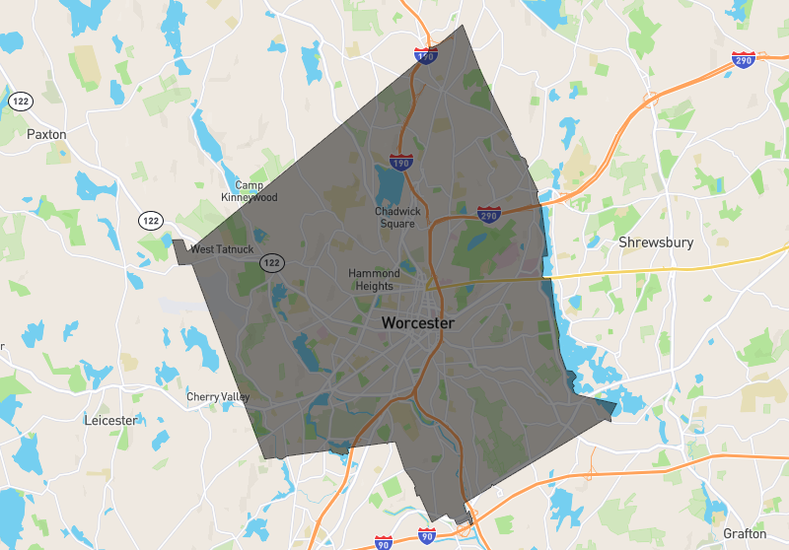

* Once we know the characteristics and neighborhoods that you want for your property, we create a custom search for you that will alert you with emails when new listings that meet your criteria hit the market. It will also alert you to price reductions.

Start now by giving us your property criteria in the form here and we’ll set up your custom search today!

Finding the right home for you is our primary goal, but enjoying it with a lower payment and better mortgage terms is a very important secondary goal. We’ve researched and worked with many mortgage brokers and lenders in the local real estate markets, and we’ll help you to contact those that are the best fit for you and your financial picture.

The normal mortgage for working families – Just because there’s nothing special about your income stream, and you’re getting a paycheck every week, that doesn’t mean that there won’t be differences in mortgages and lenders for your needs. Every mortgage broker and most lenders tend to work within their own requirements and procedures, and these may or may not be the friendliest terms for a salaried or hourly wage earner. We know which are going to treat you right and give you the best terms, and we’ll guide you to them.

The self–employed borrower – Since the mortgage and housing crisis that began in 2007, it’s become a grueling process for a business owner or self–employed person to get a mortgage. Documentation of income and expenses is much more detailed, and we're up–to–date on all of it. We’ll steer you toward multiple sources for great mortgages for the self–employed.

Less than stellar credit – All types of lenders have become tougher in our new financial environment, and it’s easy to get a ding or two on your credit these days. It doesn’t even take a mistake or late payment, as credit scores are reduced for the amount and ratio of debt, as well as types of debt. Millions of people pay their bills on time and still don’t have those high end credit scores. We know the lenders in the local real estate markets ready to provide good mortgages for less than high end credit scores, and we’ll tell you who they are.

ARMs and When They're Appropriate – Though most residential home buyers are buying a home they intend to occupy for a number of years, on average around the country at least eight, this isn't always the case. Also, investors may be looking at a shorter ownership time frame. ARMs, Adjustable Rate Mortgages, are appropriate if the plan is to own a home seven or fewer years, particularly five or fewer. Because the lender is tying up their money for a shorter defined time period, they loan at lower interest rates. ARMs can result in hundreds of dollars a month in lower payments in some cases. They can also allow a buyer to qualify for a larger home. However, this isn't generally a great practice, as once the ARMs fixed rate interest period is over, rates can escalate more than expected.

Financial Disclosure and Deal-To-Closing Considerations – Especially after the mortgage and housing problems that began in 2007, lenders and their underwriters are scrutinizing financial, income and expense information much more closely than ever before. Be prepared to dig out a lot of documentation, and it’s best to be forthcoming with any financial information that impacts your ability to pay the mortgage payment. Even if it’s not asked for early in the process, be prepared for questions and requests for documents throughout the process. Also, it’s highly recommended that you not add any credit card or other debt between the purchase contract and the closing. Just before closing, most lenders will do another credit check and a check for any liens or encumbrances.

Watch the Fees and Question Them – There are a number of fees associated with getting a mortgage, and the total of origination and other fees is usually the highest closing cost aggregate item in the deal. Never hesitate to ask about all fees, why they’re charged and why they’re a certain amount and how they’re calculated. It’s your money, and you’re the customer.

We love helping real estate buyers to find the perfect property. But we love even more the ways in which we can help them to buy it at the very best price with the very best terms. Sometimes negotiations aren’t all price. A great contract can involve other seller concessions that create the right deal for our buyer clients.

Real estate market data –How can you be expected to make price offer decisions in a vacuum? We spend a great amount of time and effort in collecting market data to help my buyers in their price negotiations. This data involves not only sold property prices by neighborhood, but also current listing pricing to determine the competitive nature of the market.

This data is very thorough, and it’s call a Comparative (or Competitive) Market Analysis. There are two parts, the comparison of the property you’re considering to similar properties recently sold in the nearby area. This gives me a firm grip on what has happened in the near past, but by nature it is “past” data, thus possibly not accurate for the market as it is when you’re in negotiations. We then do another CMA process on the currently listed properties most like the one under consideration and in the same neighborhood or nearby. This gives us a current market snapshot so that we can adjust our valuation model and our offer to reflect the current market situation.

Thorough knowledge of your situation – Only through constant communication we can advise you properly in pricing negotiations. By understanding your motivations and financial capabilities, we can help you craft a price negotiation strategy with the highest probability of success.

Seller motivation research – While it’s not always legally possible to determine why someone is selling, there are things we can glean from their listing and price activity that will allow us to help you to negotiate from a position of strength.

It’s not all money – There are a lot of ways to negotiate a real estate deal, and they don’t always involve money. Perhaps the seller doesn’t have a lot of ability to work with you on price, but they can make other concessions that could result in a deal. We help you to take the best approach.

It’s not over till it’s over – Many real estate price negotiations involve multiple counter offers and a lot of back–and–forth. We're with you with each counter offer to adjust your negotiation strategy accordingly. Because we can’t know the seller’s financial limitations in many deals, some buyers are elated when they cut a major low-priced deal on a home, but then after inspections they hit a brick wall in negotiations with the seller related to repairs. The negotiation to purchase a home isn’t over with the price on the contract, and it’s best to know that a real deal at the front end could result in less flexibility after inspections in the repairs discussion.

Many buyers forget that the price isn’t the only or the last negotiation point in a real estate purchase. There are a number of contingencies and processes that happen before closing, and one that frequently causes deals to evaporate is the inspection and repair negotiation process.

Inspections in a real estate deal encompass many property aspects:

*Structure

*Roof

*Mechanical equipment

*Plumbing

*Electrical

*Pests & insect infestation

*Mold & other environmental hazards

*Wells & water quality

*Septic systems

While your deal may not require them all, and some may be combined and provided by a single inspector, it’s our job to help you to order the proper inspections, schedule them, and make sure that they’re completed on time. Failure to complete inspections and object to their results by deadline dates can result in the buyer’s inability to take any action based on the late results. We make sure that this doesn’t happen.

Once an inspection is completed, there can be issues uncovered that you weren’t expecting and want to have addressed by the seller. This is a second negotiation in the contract process. We go over inspection results with my buyers and prepare documents that are required to request seller action and corrections. Sellers do not normally have an obligation to undertake corrective action, so it becomes a critical negotiation, especially if the problems are significant.

We're here for our buyers to assist in these negotiations as, next to selling price, inspections and subsequent repairs are the biggest killer of real estate deals. Sometimes creativity needs to be applied to keep your home deal moving when the seller balks at your repair or corrective action requests. We're experts, as we do this every day. We also maintain an extensive contractor list that can yield just the right contractor to get a job done at a price the seller will agree to.

The key to keeping a deal going with inspection problems is for me to be involved every step of the way, as it’s something we do numerous times every year. We ’ll make sure that every resource is employed to keep your home purchase on track and gain every possible concession from the sellers.

Basic level real estate service would be delivering you the documents involved in title research and the insurance binder and letting you wade through the book–sized document on your own. Believe it or not, that’s the approach many real estate agents take, and some don’t even give the documents a cursory once–over. It’s true that properties that have changed hands before, generally don’t have major title issues, but you can never know for sure without a thorough reading and understanding of the documents involved.

There are also restrictions and covenants revealed in your Title Binder or Commitment package that you may not have known about when you made your offer. Though you may have read disclosure documents or even a copy of subdivision or condominium covenants, it could be that there have been changes since it was printed. The only way you would find out is to read your title insurance binder’s copy of the documents, as it will include the latest documents as recorded at the courthouse. You may also find some recent filings related to obligations of the homeowner association that could result in future expensive assessments.

Any covenants and restrictions you notice in these documents that may restrict your use of the property in a way that causes you to reconsider your purchase would be important, and you’ll not want to miss them. Let’s say that you have a recreational vehicle and intend to park it on your property. Maybe you even plan on creating a shed for it. Any restrictions to the contrary would be important to you, and I'm committed to helping you to uncover every important item in your title insurance documents.

Along with all of those documents that look like a large encyclopedia, there are two sections at the front of the title insurance binder (or commitment) that summarize what’s included and can give you a quick overview to guide you to the most important items first, or those of most concern. These two sections are the “Requirements,” and the “Exceptions.” Requirements are things the title company says must be done or criteria met before their binder is good and title insurance will be issued. Generally, these are pretty cut-and-dried, such as the seller paying off any mortgages or liens against the property, paying current taxes due, etc.

The “Exceptions” are where you’ll find the things that could be a problem for you, such as those restrictions we discussed above. However, some people aren’t quite up-to-speed on what an exception is and what it means that an item is excepted. Most of the benefit of title insurance comes from protection from threats to your ownership or things that come up about property lines or encroachments. When something is already recorded at the courthouse, the title company will not cover you against it in the future, as it’s a “done deal,” and normally can’t be changed. Those restrictions and covenants are that way. If they say you can’t store that RV, then you can’t claim damages later when you try to do that. So, anything that’s already of record will be “excepted,” and you just need to be sure that there isn’t anything in that pile you can’t live with.

You’re the customer, and your money is making this deal work, so don’t be shy about asking any and all questions you have about the documents, requirements and exceptions in the title binder. There are deadlines for objections to what you find that could result in the deal dying, so don’t hesitate to get right to the examination of this document and the attachments.

It’s both exciting and stressful negotiating a real estate purchase contract. Once it’s signed by the sellers, buyers can relax a bit, but we can’t. There are still more negotiations, document deliveries, inspections, title details and mortgage tasks to be accomplished to reach a successful closing and walk away with the keys to your new real estate property.

There are more than 50 specific due dates and tasks on our average transaction checklist, but an overview of a few includes:

*Post contract delivery of documents to the title company and ordering of a title binder or commitment.

*Deposit of earnest money and delivery of receipt to the buyer client.

*Helping our buyers to order inspections and coordinating them and providing access to assure they’re completed on time.

*Coordinating timely delivery of any documents objecting to disclosures, inspection results, or title binder issues discovered.

*Coordinating appraisal and appraiser access.

*Working with mortgage company and coordinating delivery of documents they require.

*Assisting our buyers with any negotiations related to contingencies, inspections or documents.

*Constant monitoring of status of all processes at the title company.

There are a number of companies and people involved in a real estate transaction, including attorneys, surveyors, appraiser, title company, mortgage broker, lender, loan underwriter, both agents, and possibly others.

Each has specific duties and requirements, and each is concentrating on doing a good job for you. However, their focus is narrow, targeted on their specific niche in the deal. As your buyer agents, we're your “go-to” resource to bring it all together. We're here to coordinate the activities of all of these companies and people for you.

We're constantly monitoring those 50+ document delivery items and the work done by these people. Daily we check the progress against contractual deadlines and act on our project requirements. A lot of this activity goes on behind the scenes and you’re not even bothered. Some of it requires that we contact you and request documents or actions. Please understand that my overriding goal is a smooth transaction, and getting you through meeting all deadlines is one of our jobs. We’ll only bother you when necessary, telling you what we need and when, and moving you through to a successful closing.

There is a lot more, but those are the highlights, and many sub–tasks are related to each of them. We're obsessed with proper follow–up and detailed coordination of every step of the closing process for my buyer clients. It’s critical that we make all deadlines and keep the transaction on track to avoid defaulting on any terms of the contract. We’ll keep your real estate transaction on track, and you’ll have the time and advice you need to assure you’ve covered all of the bases prior to closing.

Your Guide To Buying

BUY WITH THE BEST AGENT IN THE BOSTON AREA

Your home will likely be the greatest financial investment you’ll ever make. We would also like to help it be your wisest.

Give yourself every opportunity to come out on top by working with Oak Realty.

Full-service buying experience

We have the strategies, resources, and tools to guide you from start to finish, seamlessly.

We will help you negotiate and secure the best possible price and terms for you when presenting offers.

We will not stop working for YOU until you are happy with the home you are in.

We have access to exclusive properties and potential off-market opportunities across Boston and surrounding areas.

Expert Advice

I will help you negotiate and secure the best possible price and terms for you. If you don’t find any home in your price range, I suggest that it’s reasonable to look at homes that are over your maximum price range.

This is to anticipate a potential price drop that could be negotiated. Over my 25 years of experience, I’ve dealt with this kind of situation regularly. It’s very important that you’re available either by phone or in person in the event a counter offer is made on your offer.

Your Guide to the St.Louis area.

With all of the beauty that the St.Louis area has to offer, it’s hard to find the perfect place to call home. My area guides simplify that process by giving you unique market, lifestyle, and demographic insights into each area!